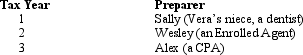

Vera is audited by the IRS for three tax years.Her returns were prepared by the following parties, to each of whom Vera paid a professional fee.  Vera wants help in appearing before the IRS Revenue Agent for the audit. Which of the following statements is correct?

Vera wants help in appearing before the IRS Revenue Agent for the audit. Which of the following statements is correct?

A) Sally may represent Vera for all tax years involved.

B) Wesley may represent Vera, but only for tax year 2.

C) Alex can represent Vera, but only for tax year 3.

D) Vera may represent herself for all tax years involved.

Correct Answer:

Verified

Q58: When a practitioner discovers an error in

Q62: About _% of all Forms 1040 are

Q67: Roger prepared for compensation a Federal income

Q68: Which of the following is subject to

Q69: A registered tax return preparer who is

Q70: A tax preparer is in violation of

Q71: Minnie, a calendar year taxpayer, filed a

Q74: Circular 230 allows a tax preparer to:

A)Take

Q75: Freddie has been assessed a preparer penalty

Q79: The usual three-year statute of limitations on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents