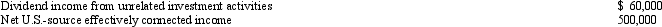

BrazilCo, Inc., a foreign corporation with a U.S.trade or business, has U.S.-source income as follows.

Determine BrazilCo's total U.S.tax liability for the year, assuming a 35% corporate rate and no tax treaty.BrazilCo leaves its U.S.branch profits invested in the United States and does not otherwise repatriate any of its U.S.assets during the year.

Determine BrazilCo's total U.S.tax liability for the year, assuming a 35% corporate rate and no tax treaty.BrazilCo leaves its U.S.branch profits invested in the United States and does not otherwise repatriate any of its U.S.assets during the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: RainCo, a domestic corporation, owns a number

Q123: With respect to income generated by non-U.S.

Q124: Describe and diagram the timeline that most

Q125: The § 367 cross-border transfer rules seem

Q126: Discuss the primary purposes of income tax

Q133: Arendt, Inc., a domestic corporation, purchases a

Q140: Match the definition with the correct term.

Q143: Your client holds foreign tax credit (FTC)

Q146: Given the following information, determine whether Greta,

Q146: Freiburg, Ltd., a foreign corporation, operates a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents