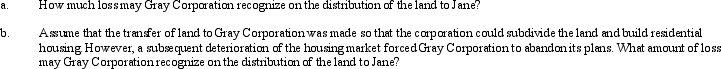

Mary and Jane, unrelated taxpayers, own Gray Corporation's stock equally.One year before the complete liquidation of Gray, Mary transfers land (basis of $420,000, fair market value of $350,000) to Gray Corporation as a contribution to capital.Assume that Mary also contributed other property in the same transaction having a basis of $20,000 and fair market value of $95,000.In liquidation, Gray distributes the land to Jane.At the time of the liquidation, the land is worth $290,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Indigo has a basis of $1 million

Q42: Which of the following statements is correct

Q44: The stock of Cardinal Corporation is held

Q45: After a plan of complete liquidation has

Q45: All of the following statements are true

Q52: Korat Corporation and Snow Corporation enter into

Q54: Bobcat Corporation redeems all of Zeb's 4,000

Q55: Which of the following statements is true

Q60: During the current year, Goldfinch Corporation purchased

Q133: Penguin Corporation purchased bonds (basis of $190,000)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents