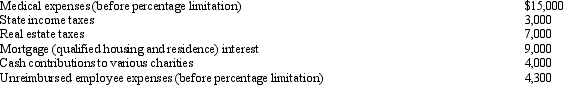

Mitch, who is single and has no dependents, had AGI of $100,000 in 2012.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2012?

A) $14,800.

B) $16,800.

C) $19,300.

D) $25,800.

E) None of the above.

Correct Answer:

Verified

Q61: Ted, who is single, owns a personal

Q65: Eula owns a mineral property that had

Q66: In 2012, Sean incurs $90,000 of mining

Q67: Factors that can cause the adjusted basis

Q68: Tad is a vice-president of Ruby Corporation.

Q69: Marvin, the vice president of Lavender, Inc.,

Q69: Robin, who is a head of household

Q72: Vinny's AGI is $220,000.He contributed $130,000 in

Q73: Which of the following statements is correct?

A)The

Q74: Akeem, who does not itemize, incurred a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents