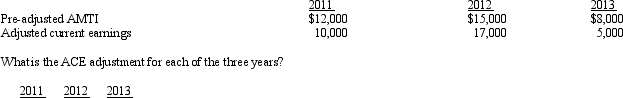

Mauve, Inc., has the following for 2011, 2012, and 2013 and no prior ACE adjustments.

A) $0 $1,500 ($1,500)

B) ($2,000) $2,000 ($3,000)

C) $2,000 ($2,000) $3,000

D) ($1,500) $1,500 $2,250

E) $1,500 ($1,500) ($2,250)

Correct Answer:

Verified

Q63: Which of the following can produce an

Q81: In May 2011, Egret, Inc.issues options to

Q82: Frederick sells land and building whose adjusted

Q83: Use the following selected data to calculate

Q84: In September, Dorothy purchases a building for

Q84: Which of the following statements is correct?

A)A

Q88: Sand Corporation, a calendar year taxpayer, has

Q88: Sage, Inc., has the following gross receipts

Q89: Lavender, Inc., incurs research and experimental expenditures

Q90: In 2012, Louise incurs circulation expenses of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents