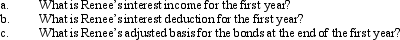

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Correct Answer:

Verified

Q4: Robert sold his ranch which was his

Q14: Felix gives 100 shares of stock to

Q15: On January 15 of the current taxable

Q17: Boyd acquired tax-exempt bonds for $430,000 in

Q18: Marge purchases the Kentwood Krackers, a AAA

Q23: Lucinda, a calendar year taxpayer, owned a

Q24: Sammy exchanges equipment used in his business

Q27: After 5 years of marriage, Dave and

Q31: On January 5, 2012, Waldo sells his

Q207: Monica sells a parcel of land to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents