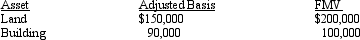

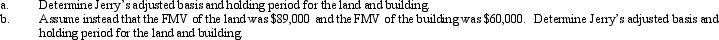

On September 18, 2012, Jerry received land and a building from Ted as a gift. Ted had purchased the land and building on March 5, 2009, and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Correct Answer:

Verified

Q3: Ed and Cheryl have been married for

Q6: Emma gives her personal use automobile (cost

Q7: Inez's adjusted basis for 9,000 shares of

Q8: Elbert gives stock worth $28,000 (no gift

Q10: Hilary receives $10,000 for a 13-foot wide

Q10: Hubert purchases Fran's jewelry store for $950,000.The

Q11: Annette purchased stock on March 1, 2012,

Q11: Misty owns stock in Violet, Inc., for

Q19: Bill is considering two options for selling

Q101: Peggy uses a delivery van in her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents