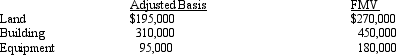

Mona purchased a business from Judah for $1,000,000. Judah's records and an appraiser provided her with the following information regarding the assets purchased:  What is Mona's adjusted basis for the land, building, and equipment?

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

Correct Answer:

Verified

Q122: Which of the following statements is false?

A)

Q127: In addition to other gifts, Megan made

Q131: Gift property (disregarding any adjustment for gift

Q132: In 2008, Harold purchased a classic car

Q134: Which of the following statements correctly reflects

Q134: Kevin purchased 5,000 shares of Purple Corporation

Q135: Melba gives her niece a drill press

Q141: Andrew acquires 2,000 shares of Eagle Corporation

Q142: Henrietta and Hollis have been married for

Q181: Alvin is employed by an automobile dealership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents