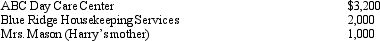

Harry and Wilma are married and file a joint income tax return. On their tax return, they report $44,000 of adjusted gross income ($20,000 salary earned by Harry and $24,000 salary earned by Wilma) and claim two exemptions for their dependent children. During the year, they pay the following amounts to care for their 4-year old son and 6-year old daughter while they work.  Harry and Wilma may claim a credit for child and dependent care expenses of:

Harry and Wilma may claim a credit for child and dependent care expenses of:

A) $840.

B) $1,040.

C) $1,200.

D) $1,240.

E) None of the above.

Correct Answer:

Verified

Q81: Which of the following statements is true

Q82: Rick spends $750,000 to build a qualified

Q83: Which of the following statements concerning the

Q86: George and Martha are married and file

Q88: Which of the following statements regarding the

Q90: In May 2012, Blue Corporation hired Camilla,

Q91: Realizing that providing for a comfortable retirement

Q92: During 2012, Eleanor earns $120,000 in wages

Q94: Golden Corporation is an eligible small business

Q95: The ceiling amounts and percentages for 2012

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents