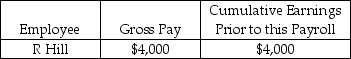

Great Lakes Tutoring had the following payroll information on February 28:  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 2% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Using the information above, the journal entry to record the employee's tax expense would include:

A) a debit to Payroll Tax Expense in the amount of $4,000.

B) a debit to Wages and Salaries Expense in the amount of $4,000.

C) a credit to Cash in the amount of $4,000.

D) a credit to FUTA Payable for $24.

Correct Answer:

Verified

Q5: Grammy's Bakery had the following information for

Q6: Great Lakes Tutoring had the following payroll

Q6: The account for Payroll Tax Expense includes

Q10: Which of the following statements is false?

A)Payroll

Q14: Wages and Salaries Payable would be used

Q23: What type of account is Payroll Tax

Q35: The debit amount to Payroll Tax Expense

Q40: The Wages and Salaries Expense account would

Q86: As the Prepaid Workers Compensation is recognized,

Q92: Prepaid Worker's Compensation Insurance is what type

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents