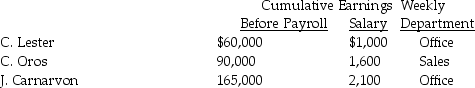

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:

Assume the following:

Assume the following:

a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Federal income tax is 15% of gross pay

c)Each employee pays $20 per week for medical insurance

Correct Answer:

Verified

Q1: What is debited if State Unemployment Tax

Q1: Why would a company use a separate

Q6: The employer's total FICA,SUTA,and FUTA tax is

Q19: Payroll Cash is a(n):

A)revenue.

B)liability.

C)asset.

D)expense.

Q20: Grammy's Bakery had the following information for

Q24: The payroll tax expense is recorded at

Q24: Payroll information for Kinzer's Interior Decorating for

Q27: Using the information provided below, prepare a

Q34: The balance in the Wages and Salaries

Q58: The employer records deductions from the employee's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents