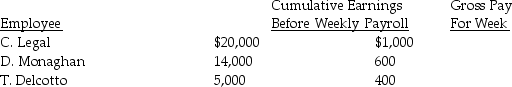

Record in the general journal the payroll tax entry for the week ended August 31. Use the following information gathered to make the entry.

a)FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

a)FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

b)Federal Unemployment is 0.8% on a limit of $7,000

c)State Unemployment is 2% on a limit of $7,000

Correct Answer:

Verified

Q19: When a business starts, what must it

Q21: The entry to record the payment of

Q30: FICA taxes are levied only on employees.

Q31: Mike's Door Service's payroll data for the

Q36: An employer must always use a calendar

Q37: Sweetman's Recording Studio payroll records show the

Q37: If Wages and Salaries Payable is debited,what

Q38: Using the information below, determine the amount

Q39: What liability account is reduced when the

Q57: Form 941 taxes include OASDI, Medicare, and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents