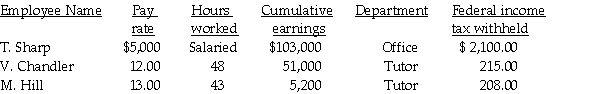

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total retirement.

Correct Answer:

Verified

Q43: The following data applies to the July

Q47: The following data applies to the July

Q76: The employer's annual Federal Unemployment Tax Return

Q77: If an employer owes less than $2,500

Q78: Prepare the general journal entry to record

Q79: The following data applies to the July

Q80: The correct journal entry to record the

Q82: Employees must receive W-3s by January 31

Q84: Ben's Mentoring had the following information for

Q85: The W-3 is filed only for odd

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents