Jane Kathryn has 30,000 shares outstanding of $10 par value, 10% preferred stock and 100,000 shares outstanding $5 par value common stock. In the first 3 years of operations, the company paid dividends in Year 1, $0; Year 2, $40,000; Year 3, $100,000. Calculate the dividend paid to preferred and common stockholders under the following independent situations:

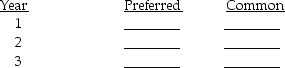

a)Preferred is non-cumulative and nonparticipating.

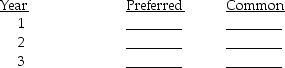

b)Preferred is cumulative and nonparticipating.

b)Preferred is cumulative and nonparticipating.

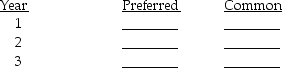

c)Preferred is cumulative and participating.

c)Preferred is cumulative and participating.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Alpha-Omega Industries has 30,000 shares of $12

Q104: Alpha-Omega Industries has 30,000 shares of $12

Q105: When a stock subscription is received,Common Stock

Q106: Nature's Honey Corporation received the final installment

Q108: In the stockholders' equity section of a

Q110: Using the following accounts:

Indicate the account(s) to

Q113: Alpha-Omega Industries has 30,000 shares of $12

Q114: Tory Company received the first installment of

Q115: The Bean Counter Corporation received subscriptions for

Q119: Sold preferred stock at a price equal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents