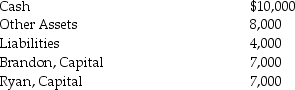

The partnership of Brandon and Ryan is being liquidated. All gains and losses are shared in a 3:1 ratio, respectively. Before liquidation, their balance sheet balances are as follows:

a)If the Other Assets are sold for $10,000, how much will each partner receive before paying liabilities and distributing the remaining assets?

a)If the Other Assets are sold for $10,000, how much will each partner receive before paying liabilities and distributing the remaining assets?

b)If the Other Assets are sold for $8,000, how much will each partner receive before paying liabilities and distributing remaining assets?

Correct Answer:

Verified

Q23: Able partner invested cash in the business.

Debit

Q37: Indicate the account(s) to be debited and

Q38: Indicate the account(s) to be debited and

Q66: Indicate the account(s) to be debited and

Q102: Partners Roger and Martin each have $3,000

Q103: After all liabilities have been paid,the remaining

Q108: Partners Eric and Jeremy each have $3,000

Q114: Which of the following is an incorrect

Q119: A Loss or Gain from Realization account

Q126: Indicate the account(s) to be debited and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents