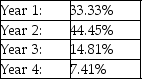

A tractor costing $80,000 is depreciated using MACRS. The tractor qualifies as a 3-year property, and has a scrap value of $20,000. The depreciation rates are:  What is the depreciation expense for year 2?

What is the depreciation expense for year 2?

A) $44,450

B) $35,560

C) $26,670

D) $20,000

Correct Answer:

Verified

Q50: For tax purposes, _ establishes the guidelines

Q61: For tax purposes,residential real property is depreciated

Q62: Revenue expenditures include:

A)additions to existing plant assets.

B)periodic

Q64: Under MACRS,furniture is depreciated over five years.

Q75: What is the difference between an extraordinary

Q77: A company expanded its manufacturing facility by

Q79: A company incorrectly records revenue expenditures as

Q98: A budgeted item such as a building

Q115: Define and compare capital expenditures and revenue

Q120: Payments for ordinary maintenance of an asset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents