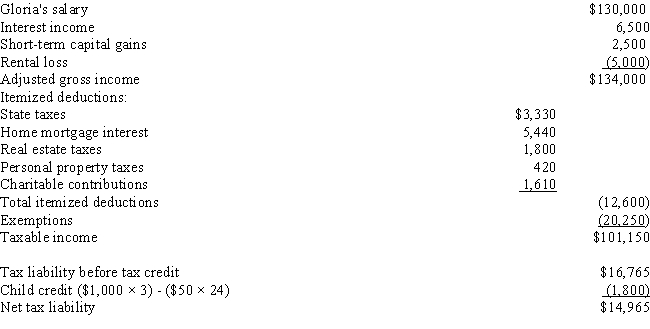

COMPREHENSIVE TAX CALCULATION PROBLEM.Girardo and Gloria are married with 3 children,ages 14,11,and 8.Gloria is a senior vice-president for a security firm and Girardo is a househusband who spends 15 hours a week doing volunteer work for local organizations.Girardo inherited $800,000 from his grandfather in 1999.He spends 10 hours a week managing the rental property they purchased with part of the inheritance and the family's stock portfolio.Prior to becoming a househusband,Girardo was an award winning high school accounting teacher.In February of 2016,Girardo is approached by the high school principal about returning to his former position.Girardo would receive an annual salary of $50,000.He is a little hesitant about accepting the offer,because he enjoys his volunteer work.Girardo's accountant has provided him with the following projection of their 2017 tax liability:

Girardo's projection from his accountant does not include his salary from teaching.Assume that Girardo's pro-rata salary for the year will be $30,000.Calculate Girardo and Gloria's tax liability,if Girardo decides to return to teaching.Also determine the marginal and effective tax rates on Girardo's salary.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q145: Indicate the proper treatment in the current

Q148: Explain the support test and the gross

Q149: Indicate the proper treatment in the current

Q151: Indicate the proper treatment in the current

Q152: Describe the rules that apply to individual

Q155: In each of the following independent cases

Q156: Indicate the proper treatment in the current

Q160: Discuss why the distinction between deductions for

Q161: COMPREHENSIVE TAX RETURN PROBLEM.Your cousin,Antonia,who is 30

Q163: Byron,54,is a single,self-employed,carpenter.During 2017,he earns gross revenues

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents