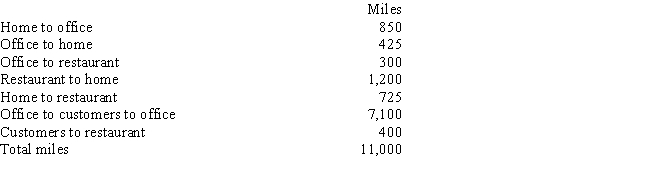

Rodrigo works as a salesperson for a auto parts manufacturer.His job requires that he spend most of his time outside the office calling on customers.In addition,to supplement his income he works 1 night a week and on weekends as a waiter at an exclusive seafood restaurant in the city.During the year,he keeps the following record of his travel:

If he uses the standard mileage rate,what amount can she deduct as a business automobile expense?

A) $3,621

B) $3,774

C) $3,941

D) $4,173

E) $6,105

Correct Answer:

Verified

Q1: Business and nonbusiness bad debts are both

Q3: A taxpayer can deduct multiple gifts to

Q13: The actual cost method is a more-flexible

Q17: For moving expenses to be deductible the

Q21: Jason travels to Miami to meet with

Q23: In 2017,Eileen,a self-employed nurse,drives her car 20,000

Q23: Olga is a technical sales consultant for

Q25: Arlene,a criminal defense attorney inherits $500,000 from

Q27: Sandra, who owns a small accounting firm,

Q36: Carter is a podiatrist in Minneapolis. He

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents