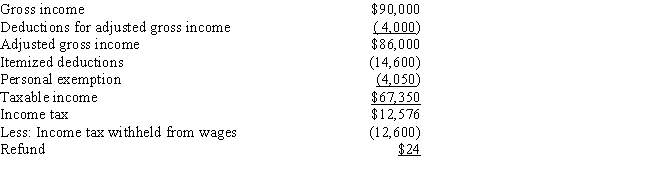

Betty is a single individual.In 2017,she receives $5,000 of tax-exempt income in addition to her salary and other investment income.Betty's 2017 tax return showed the following information:

Which of the following statements concerning Betty's tax rates is (are) correct?

I.Betty's average tax rate is 18.7%.

II.Betty's average tax rate is 17.4%.

III.Betty's effective tax rate is 18.7%.

IV.Betty's effective tax rate is 17.4%.

A) Statements I and III are correct.

B) Statements I and IV are correct.

C) Statements II and III are correct.

D) Statements II and IV are correct.

Correct Answer:

Verified

Q43: Indicate which of the following statements concerning

Q44: Lee's 2017 taxable income is $88,000 before

Q45: The mythical country of Woodland imposes two

Q47: Alan is a single taxpayer with a

Q48: Elrod is an employee of Gomez Inc.During

Q49: Sally is a single individual.In 2016,she receives

Q51: The Federal income tax is a

A)revenue neutral

Q51: Jered and Samantha are married.Their 2017 taxable

Q53: Employment taxes are

A)revenue neutral.

B)regressive.

C)value-added.

D)progressive.

E)proportional.

Q60: Greg pays sales tax of $7.20 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents