Scenic View Foods Corporation

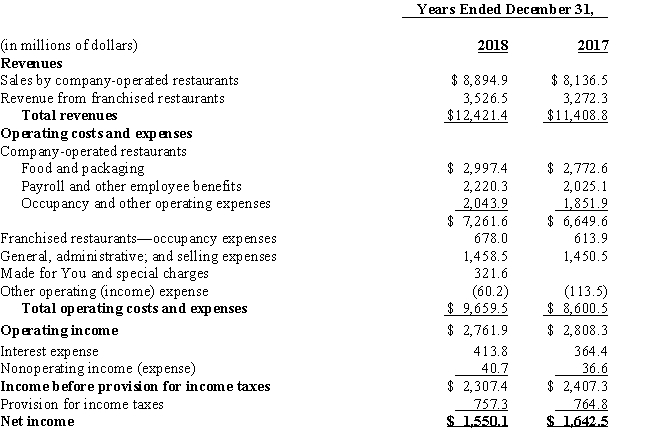

The following consolidated statements of income are for Scenic View Foods Corporation for the years ending December 31,2017 and 2018:

-Refer to the consolidated statements of income for Scenic View Foods Corporation.

Required

(1)Notice that Scenic View Foods reported "Provision for income taxes." What type of account is this? What adjustment would have been made if this accrual were necessary at December 31,2018?

(2)Scenic View Foods' reported $3.1 million and $2.8 million of accrued interest in the Liability section of its balance sheet at December 31,2018 and 2017,respectively.How much cash did it pay during 2017 for interest?

(3)Is Scenic View Foods income statement an "interim statement"? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q188: Tiva Solutions’ accounting records reflect the

Q189: Given below are the amounts from

Q190: Lowen Homes,Inc.pays its sales personnel 6% commission

Q191: Martinez Produce sells fresh vegetables and

Q192: The following unadjusted amount was reported

Q194: Malco Tile Shop purchased insurance coverage

Q195: Scenic View Foods Corporation

The following consolidated statements

Q196: Motor Repair Shop uses the accrual

Q197: Calzone,Inc.signs a 9%,four-month,$50,000 loan with Reliable Bank

Q198: Frannie's Dance Studio accounting records reflect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents