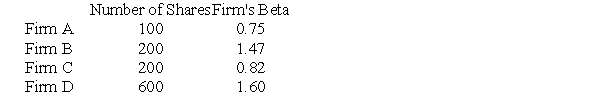

You are thinking about purchasing 1,000 shares of stock in the following firms:

If you purchase the number of shares specified,then the beta of your portfolio will be:

A) 1.16.

B) 1.35.

C) 1.00.

D) .85.

E) Cannot be determined with information given.

Correct Answer:

Verified

Q65: The rate on six-month T-bills is currently

Q77: Bell Weather,Inc.has a beta of 1.25.The return

Q83: U.S.Treasury bonds currently yield 6%.Consolidated Industries stock

Q85: You are going to invest all of

Q87: Firm B's risk premium is

A) 2.66%.

B) 4.8%.

C)

Q88: The market risk premium is measured by

A)

Q89: If investors expected inflation to increase in

Q90: What would happen if investors became more

Q91: Use the following information to answer the

Q93: The risk-free rate is currently 6.5%.Acid Battery

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents