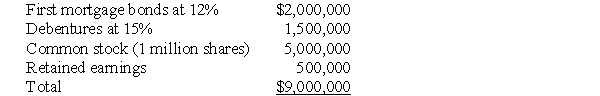

Sunshine Candy Company's capital structure for the past year of operation is shown below.

The federal tax rate is 50%.Sunshine Candy Company,home-based in Orlando,wants to raise an additional $1 million to open new facilities in Tampa and Miami.The firm can accomplish this via two alternatives: (1)it can sell a new issue of 20-year debentures with 16% interest;or (2)20,000 new shares of common stock can be sold to the public to net the candy company $50 per share.A recent study,performed by an outside consulting organization,projected Sunshine Candy Company's long-term EBIT level at approximately $6.8 million.Find the indifference level of EBIT (with regard to EPS)between the suggested financing plans.

Correct Answer:

Verified

[(EB...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q93: The total interest obligation will be

A) $105,000

Q95: The EBIT-EPS indifference point

A) identifies the EBIT

Q102: Benchmarking the company's capital structure is popular

Q104: Allston-Brighton Corp. has total assets of $10

Q107: The EBIT-EPS indifference point, sometimes called the

Q108: The MAX Corporation is planning a $4

Q109: Comparative leverage ratio analysis does not involve

Q110: High coverage ratios, compared with a standard,

Q112: Young Enterprises is financed entirely with 3

Q114: Roberts, Inc. is trying to decide how

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents