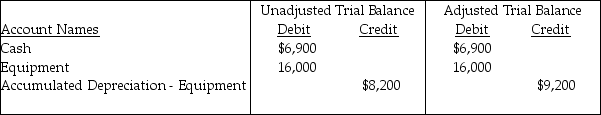

The following extract was taken from the worksheet of Kelly Bakers for the year 2016. Kelly takers

Worksheet

December 31, 2016  For the above information,determine the amount of Depreciation Expense for the equipment used in the business.

For the above information,determine the amount of Depreciation Expense for the equipment used in the business.

A) $9,200

B) $2,300

C) $6,800

D) $1,000

Correct Answer:

Verified

Q162: On September 1,Peterson Maintenance Company contracted to

Q163: Avalon Event Planning Services,Inc.records deferred expenses and

Q164: On March 1,2016,LeBlanc,Inc.paid $60,000 for office rent

Q165: Wentlent Services,Inc.records deferred expenses as expenses when

Q166: On September 1,Capitol Maintenance Company contracted to

Q169: Stancil Enterprises prepaid four months of office

Q170: On December 15,Duncan Services,Inc.collected revenue of $3,000

Q172: Sierra Event Planning Services,Inc.records deferred expenses and

Q208: The accounts that are used in a

Q216: Deferred expenses are also called prepaid expenses.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents