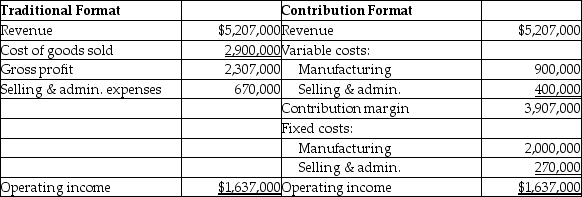

Melville Company makes special equipment used in cell towers.Each unit sells for $410.Melville produces and sells 12,700 units per year.They have provided the following income statement data:  A foreign company has offered to buy 85 units for a reduced sales price of $320 per unit.The marketing manager says the sale will not affect the company's regular sales.The sales manager says that this sale will require incremental selling and administrative costs,as it is a one-time deal.The production manager reports that it would require an additional $20,000 of fixed manufacturing costs to accommodate the specifications of the buyer.If Melville accepts the deal,how will this impact operating income? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A foreign company has offered to buy 85 units for a reduced sales price of $320 per unit.The marketing manager says the sale will not affect the company's regular sales.The sales manager says that this sale will require incremental selling and administrative costs,as it is a one-time deal.The production manager reports that it would require an additional $20,000 of fixed manufacturing costs to accommodate the specifications of the buyer.If Melville accepts the deal,how will this impact operating income? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A) Operating income will increase by $1,501.

B) Operating income will decrease by $1,501.

C) Operating income will increase by $27,200.

D) Operating income will decrease by $18,499.

Correct Answer:

Verified

Q64: Venlite,Inc.produces and sells cosmetic products.Currently,the company is

Q68: Australia Company manufactures sonars for fishing

Q69: Lighthouse Sail Makers manufactures sails for

Q70: Potlatch Company manufactures sonars for fishing

Q73: In deciding whether to accept a special

Q74: High Seas Sail Makers manufactures sails

Q75: Special pricing orders increase operating income if

Q77: Gardner Sail Makers manufactures sails for

Q78: Bridge Company makes special equipment used in

Q80: A customer of Mason Manufacturing has requested

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents