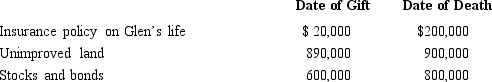

In 2012, Glen transferred several assets by gift to different persons. Glen dies in 2014. Information regarding the properties given is summarized below. Fair Market Value The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000. As to these transactions, Glen's gross estate must include:

The transfer of the land and the stocks and bonds resulted in a total gift tax of $60,000. As to these transactions, Glen's gross estate must include:

A) $0.

B) $200,000.

C) $260,000.

D) $1,900,000.

E) $1,960,000.

Correct Answer:

Verified

Q88: In which of the following situations has

Q104: At the time of his death,Norton was

Q113: Before his nephew (Dean) leaves for college,

Q114: Stacey inherits unimproved land (fair market value

Q116: Tom and Jean are husband and wife

Q117: Andrea dies on April 30, 2013. Which,

Q120: At the time of her death on

Q121: Homer and Laura are husband and wife.

Q122: At the time of her death, Sophia

Q123: Gerald and Pat are husband and wife

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents