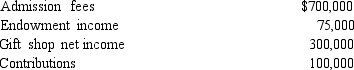

First Americans, Inc., a § 501(c)(3) organization, operates a museum which depicts the lives of a tribe of Native Americans. It charges an admission fee, but also finances its operations through endowment income, contributions, and gift shop sales. The gift shop is operated by 50 volunteers and the museum is operated by 15 employees. Revenue by source is:

a. Determine the amount of First Americans' unrelated business income.

b. Determine the amount of First American's unrelated business income tax (UBIT).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Hope,Inc. ,an exempt organization,owns a factory building

Q105: Under what part of § 501(c) are

Q107: Why are some organizations exempt from Federal

Q107: Discuss the relationship between the qualification requirements

Q110: Ice, Inc., a § 501(c)(3) organization, has

Q114: Are organizations that qualify for exempt organization

Q118: Discuss benefits for which an exempt organization

Q123: Are some exempt organizations eligible to be

Q132: Watch, Inc., a § 501(c)(3) exempt organization,

Q135: Midnight Basketball, Inc., an exempt organization that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents