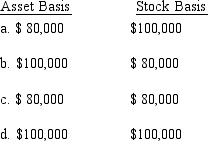

Alanna contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

E) None of the above.

Correct Answer:

Verified

Q64: Bart contributes $100,000 to the Fish Partnership

Q73: Khalid contributes land (fair market value of

Q91: Devon owns 40% of the Agate Company

Q92: Kirby, the sole shareholder of Falcon, Inc.,

Q94: Melba contributes land (basis of $190,000; fair

Q95: Duck, Inc., is a C corporation that

Q97: Kristine owns all of the stock of

Q98: Blue, Inc., has taxable income before salary

Q100: Which of the following statements is incorrect?

A)

Q101: Kirk is establishing a business in 2014

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents