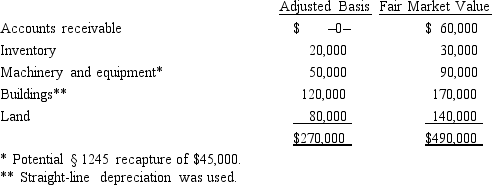

Mr. and Ms. Smith's partnership owns the following assets:  Mr. and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Mr. and Ms. Smith each have a basis for their partnership interest of $135,000. Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Q57: Amber, Inc., has taxable income of $212,000.

Q67: Alice contributes equipment (fair market value of

Q69: Malcomb and Sandra (shareholders) each loan Crow

Q79: Audry has an ownership interest in a

Q81: Catfish, Inc., a closely held corporation which

Q82: Daisy, Inc., has taxable income of $850,000

Q84: Which of the following special allocations are

Q86: Paul's AMT base is $450,000. Green, Inc.'s

Q88: Martin contributes property with an adjusted basis

Q89: Candace, who is in the 33% tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents