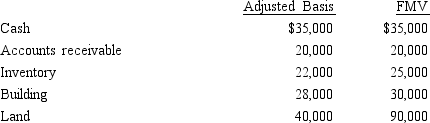

Lee owns all the stock of Vireo, Inc., a C corporation for which he has an adjusted basis of $150,000. The assets of Vireo, Inc., are as follows:

Lee sells his stock to Katrina for $300,000.

Lee sells his stock to Katrina for $300,000.

a. Determine the tax consequences to Lee.

b. Determine the tax consequences to Katrina.

c. Determine the tax consequences to Vireo, Inc.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: Meg has an adjusted basis of $150,000

Q93: List some techniques for reducing and/or avoiding

Q111: Ralph owns all the stock of Silver,

Q112: What is the major pitfall associated with

Q114: Lisa is considering investing $60,000 in a

Q115: Included among the factors that influence the

Q115: Melanie and Sonny form Bird Enterprises. Sonny

Q116: Which of the following business entity forms

Q117: Sam and Vera are going to establish

Q118: Abby is a limited partner in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents