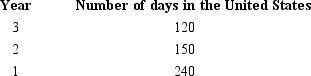

Given the following information, determine whether Greta, an alien, is a U.S. resident for Year 3. Greta cannot establish a tax home in or a closer connection to a foreign country.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: Match the definition with the correct term.

-Bilateral

Q106: Match the definition with the correct term.

Q109: Match the definition with the correct term.

-Foreign

Q113: Match the definition with the correct term.

-A

Q117: Match the definition with the correct term.

Q120: Match the definition with the correct term.

-A

Q124: Describe and diagram the timeline that most

Q134: BrazilCo, Inc., a foreign corporation with a

Q143: Your client holds foreign tax credit (FTC)

Q159: Britta, Inc., a U.S. corporation, reports foreign-source

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents