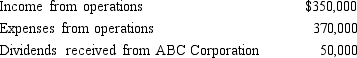

During the current year, Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q65: Which of the following statements is correct

Q69: Schedule M-1 of Form 1120 is used

Q81: During the current year,Skylark Company had operating

Q82: Ostrich, a C corporation, has a net

Q83: Warbler Corporation, an accrual method regular corporation,

Q84: Amber Company has $100,000 in net income

Q88: During the current year, Maroon Company had

Q89: Almond Corporation, a calendar year C corporation,

Q90: During the current year, Gray Corporation, a

Q90: Robin Corporation, a calendar year C corporation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents