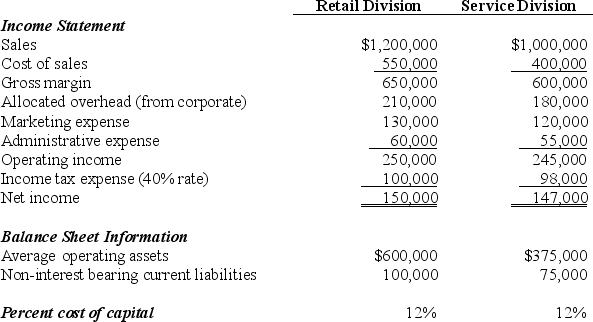

Becky's Bikes Inc.has two divisions: Retail and Service.The following information is for each division at Becky's Bikes for the most recent fiscal year.

To calculate EVA,management requires adjustments for marketing and non-interest bearing current liabilities as outlined below.

Marketing will be capitalized and amortized over several years resulting in an increase to average operating assets of $50,000 for the Retail division and $32,500 for the Services division.On the income statement,marketing expense for the year will be added back to operating income,then marketing amortization expense for one year will be deducted.The current year amortization expense will total $30,000 for the Retail division and $20,000 for the Services division.

Non-interest bearing liabilities will be deducted from average operating assets.

Calculate economic value added (EVA)for each division and comment on your results.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Exhibit 11-5

Sports Products Inc.sells skis and

Q47: All of the following are true about

Q51: Exhibit 11-5

Sports Products Inc.sells skis and

Q53: Exhibit 11-4

The following information is for

Q53: Genoa Equipment Company has three separate divisions:

Q54: All of the following are false about

Q56: Petra Company has the following information available

Q57: Exhibit 11-5

Sports Products Inc.sells skis and

Q61: Car Deals Inc.has two divisions: New Cars

Q61: Pete's Paint Company produces paint and has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents