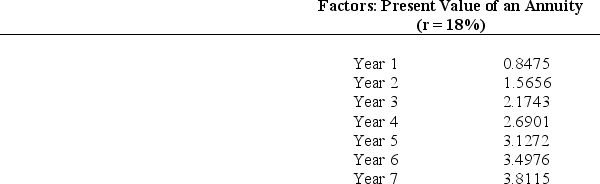

Lanyard Company is considering an investment that will generate $600,000 in cash inflows per year for 7 years and has $240,000 of cash outflows for the same period (before income taxes) .The cost of the asset is $700,000 and it will be depreciated using straight-line depreciation over the 7 year life.The asset has no salvage value.Lanyard's tax rate is 40%.The cost of capital is 18%.

What is the net present value of this investment (rounded to the nearest dollar) ?

A) $275,744

B) ($105,406)

C) $504,434

D) $123,284

E) None of the answer choices is correct.

Correct Answer:

Verified

Q41: When using Excel,all of the following are

Q43: Landscaping Inc.would like to purchase a tractor

Q47: Horizon Company produces a variety of boating

Q47: Venture Company has two independent investment opportunities,each

Q49: Exhibit 8-2

Liam Company has two independent

Q51: For organizations that do not pay income

Q55: Exhibit 8-3

Yale Inc.has two independent investment

Q57: All of the following are qualitative factors

Q60: Exhibit 8-3

Yale Inc.has two independent investment

Q63: Before income taxes,Farley Company had revenues of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents