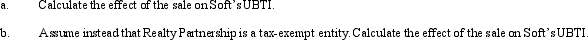

Soft, Inc., a § 501(c)(3) organization, has been leasing a building to Ice, Inc., a taxable entity, for 12 years.The lease terminates in the current tax year.Soft's adjusted basis for the building is $350,000.It sells the building to the Realty Partnership, a taxable entity, for $625,000.Selling expenses are $37,500.

Correct Answer:

Verified

Q99: Medical, Inc., a § 501(c)(3) exempt organization,

Q100: Acquisition indebtedness consists of the unpaid amounts

Q101: The Dispensary is a pharmacy that is

Q102: Warmth, Inc., a private foundation, makes an

Q103: Midnight Basketball, Inc., an exempt organization that

Q105: Wett, Inc., a § 501(c)(3) exempt organization,

Q106: City, Inc., an exempt organization, has included

Q107: Why are some organizations exempt from Federal

Q109: Assist, Inc., a § 501(c)(3) organization, receives

Q114: Are organizations that qualify for exempt organization

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents