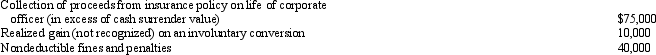

Platinum Corporation, a calendar year taxpayer, has taxable income of $500,000.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

Disregarding any provision for Federal income taxes, Platinum Corporation's current E & P is:

A) $455,000.

B) $535,000.

C) $545,000.

D) $625,000.

E) None of the above.

Correct Answer:

Verified

Q56: In applying the stock attribution rules to

Q57: As a result of a redemption, a

Q58: In a not essentially equivalent redemption [§

Q58: In determining whether a distribution qualifies as

Q59: Betty's adjusted gross estate is $9 million.The

Q61: Renee, the sole shareholder of Indigo Corporation,

Q62: Ashley and Andrew, equal shareholders in Parrot

Q64: Orange Corporation has a deficit in accumulated

Q65: On January 2, 2012, Orange Corporation purchased

Q82: At the beginning of the current year,Doug

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents