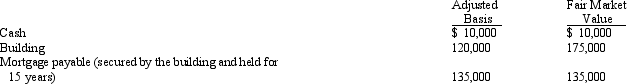

Dick, a cash basis taxpayer, incorporates his sole proprietorship.He transfers the following items to newly created Orange Corporation.  With respect to this transaction:

With respect to this transaction:

A) Orange Corporation's basis in the building is $120,000.

B) Dick has no recognized gain.

C) Dick has a recognized gain of $5,000.

D) Dick has a recognized gain of $10,000.

E) None of the above.

Correct Answer:

Verified

Q53: Three individuals form Skylark Corporation with the

Q55: Kevin and Nicole form Indigo Corporation with

Q56: Amy owns 20% of the stock of

Q57: Rob and Fran form Bluebird Corporation with

Q60: Lucy transfers equipment (basis of $25,000 and

Q62: Nancy, Guy, and Rod form Goldfinch Corporation

Q67: Wade and Paul form Swan Corporation with

Q68: Earl and Mary form Crow Corporation. Earl

Q73: Sarah and Tony (mother and son) form

Q87: When Pheasant Corporation was formed under §

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents