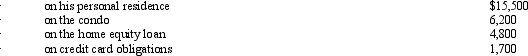

Ted, who is single, owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2012, he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2012, he paid the following amounts of interest:  What amount, if any, must Ted recognize as an AMT adjustment in 2012?

What amount, if any, must Ted recognize as an AMT adjustment in 2012?

A) $0.

B) $4,800.

C) $6,200.

D) $11,000.

E) None of the above.

Correct Answer:

Verified

Q70: Wallace owns a construction company that builds

Q71: In 2012, Amber had a $100,000 loss

Q72: Vinny's AGI is $220,000.He contributed $130,000 in

Q73: Which of the following statements is correct?

A)The

Q74: Akeem, who does not itemize, incurred a

Q76: Which of the following normally produces positive

Q77: Celia and Amos, who are married filing

Q78: Robin, who is a head of household

Q79: Which of the following itemized deductions definitely

Q80: Prior to the effect of tax credits,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents