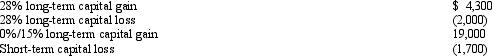

Harold is a head of household, has $27,000 of taxable income in 2012 from non-capital gain or loss sources, and has the following capital gains and losses:

What is Harold's taxable income and the tax on that taxable income?

What is Harold's taxable income and the tax on that taxable income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Hilda lent $2,000 to a close personal

Q116: Theresa and Oliver, married filing jointly, and

Q117: A retail building used in the business

Q118: On January 10, 2012, Wally sold an

Q119: The chart below details Sheen's 2010, 2011,

Q120: An individual has a $20,000 § 1245

Q123: In early 2011, Wendy paid $66,000 for

Q124: A business machine purchased April 10, 2010,

Q125: Mike is a self-employed TV technician.He is

Q126: Betty, a single taxpayer with no dependents,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents