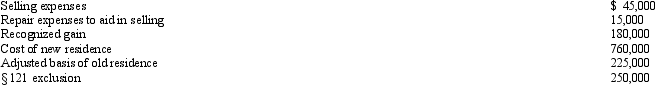

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: On September 18, 2012, Jerry received land

Q17: Boyd acquired tax-exempt bonds for $430,000 in

Q18: Elbert gives stock worth $28,000 (no gift

Q19: Bill is considering two options for selling

Q20: Felix gives 100 shares of stock to

Q22: Eunice Jean exchanges land held for investment

Q23: Katrina, age 58, rented (as a tenant)

Q24: Samuel's hotel is condemned by the City

Q26: For each of the following involuntary conversions,

Q216: When a property transaction occurs, what four

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents