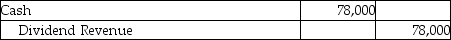

Gaines Corporation invested $114,000 to acquire 24,000 shares of Owens Technologies,Inc.on March 1,2018.On July 2,2019,Owens pays a cash dividend of $3.25 per share.The investment is classified as equity securities with no significant influence.Which of the following is the correct journal entry to record the transaction on July 2,2019?

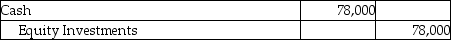

A)

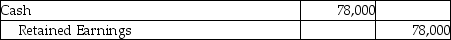

B)

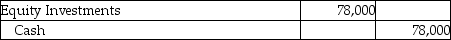

C)

D)

Correct Answer:

Verified

Q82: When a company receives a dividend payment

Q83: Hardin Co.purchased $1,000,000 of 4% bonds of

Q92: Equity securities,in which the investor lacks the

Q92: Franklin Corporation invested $100,000 to acquire 20,000

Q95: When a company collects the face value

Q102: Orbit Services,Inc.pays $700,000 to acquire 30% (200,000

Q102: Under the equity method,the Equity Investments account

Q103: Under the equity method,the investee must annually

Q105: Significant influence equity investments must be accounted

Q110: World-wide Financial Services,Inc.invested $27,000 to acquire 4000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents