The Following Condensed Income Statement Is for Mason Inc Compute the Following Ratios for 2017,and Provide a Brief Explanation

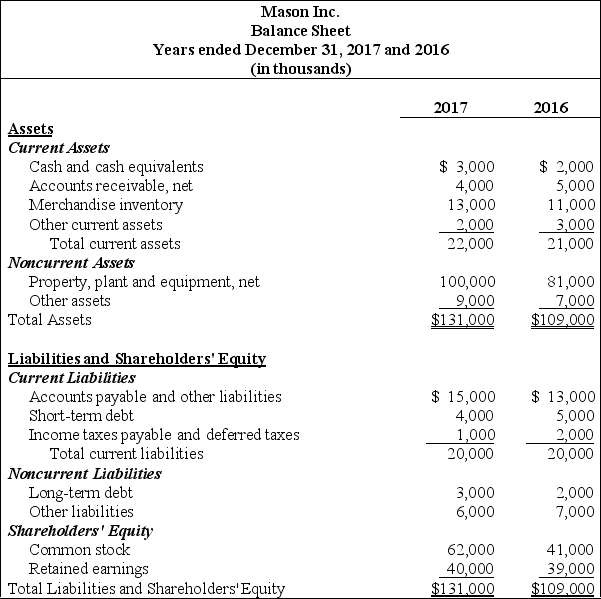

The following condensed income statement is for Mason Inc.

Compute the following ratios for 2017,and provide a brief explanation after each ratio (round percentage computations to one decimal place and earnings per share to two decimal places):

(1)Gross margin ratio

(2)Profit margin ratio

(3)Return on assets

(4)Return on common shareholders' equity

(5)Earnings per share (assume weighted average shares outstanding totaled 2,900,000 shares)

(6)Market capitalization (assume 3,000,000 shares were issued and outstanding at December 31,2017,and the market price was $9.00 per share)

(7)Price-earnings ratio

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Which of the following is the best

Q42: The following condensed income statement is

Q43: During 2017,Columbia Inc.had beginning accounts receivable of

Q44: All of the following account balances would

Q45: If net sales is growing at a

Q47: Albany Company has net income before taxes

Q48: Which of the following types of measures

Q49: The following condensed income statement is

Q50: Which of the following types of companies

Q51: All of the following measures evaluate profitability

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents