Answer the following question(s) using the information below:

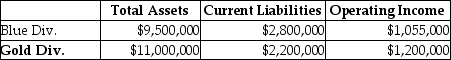

Springfield Corporation,whose tax rate is 40%,has two sources of funds: long-term debt with a market value of $8,000,000 and an interest rate of 8%,and equity capital with a market value of $12,000,000 and a cost of equity of 12%.Springfield has two operating divisions,the Blue division and the Gold division,with the following financial measures for the current year:

-What is Economic Value Added () for the Gold Division?

A) -$283,200

B) -$82,560

C) $196,800

D) $397,440

E) -$195,200

Correct Answer:

Verified

Q64: Answer the following question(s)using the information below:

Miller

Q72: LaserLife Printer Cartridge Company is a decentralized

Q75: Capital Investments has three divisions.Each division's required

Q76: Jim's Quality Pre-owned Auto Sales Ltd.allows its

Q76: Answer the following question(s)using the information below:

Miller

Q78: Answer the following question(s)using the information below:

Coldbrook

Q79: Hargrave Products has three divisions which operate

Q80: Batman Abstract Company has three divisions that

Q95: Current cost return on investment is a

Q96: Using gross book value as an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents