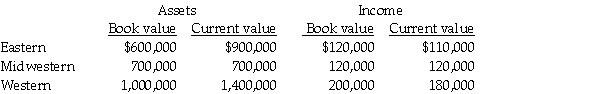

National Can Company has three divisions,Eastern,Midwestern,and Western.Because of very different accounting methods and inflation rates in different countries it is considering multiple evaluation measures.Information gathered about the divisions for the year just ended follows:

The company is currently using a required rate of return of 15 percent.

Required:

a.Compute the ROI using both book value and current value for all divisions.Round to three decimal places.

b.Compute residual income using book value and current value for all divisions.

c.Does book value or current value provide the better basis for performance evaluation? Why? Which division is the most successful?

Correct Answer:

Verified

Book value ROI: Eastern = $120,000/$6...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Answer the following question(s)using the information below:

Carriage

Q110: Answer the following question(s)using the information below:

Carriage

Q112: Use the information below to answer the

Q113: Answer the following question(s)using the information below:

Carriage

Q115: Use the information below to answer the

Q119: If a company is a multinational company

Q120: Holmes Electronics Ltd.has three divisions: Resistors,Semiconductors and

Q126: Divisions operating in different countries often record

Q130: Current cost is defined as the cost

Q142: The benefits of tying performance measures more

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents