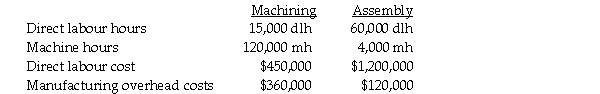

Valley Manufacturing uses departmental cost driver rates to apply manufacturing overhead costs to products.Manufacturing overhead costs are applied on the basis of machine hours in the Machining Department and on the basis of direct labour hours in the Assembly Department.The following estimates were provided at the beginning of the current year:

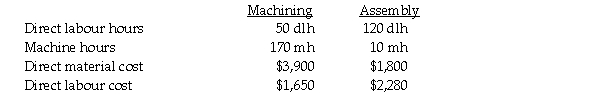

The accounting records of the company show the following data for Job #922:

Required:

a.Compute the manufacturing indirect cost allocation rate for each department.

b.Compute the total cost of Job #922.

c.Provide possible reasons why Valley Manufacturing uses predetermined rather than actual indirect manufacturing cost overhead rates.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Last week Job # WPP 298 was

Q83: Sedgewick County Hospital uses a job-costing system

Q84: Landscape Architects provides landscape consulting services to

Q85: Hill Manufacturing uses departmental cost driver rates

Q86: Fox Manufacturing is a small textile manufacturer

Q90: Cowley County Hospital uses a job-costing system

Q91: John wants to identify the total cost

Q91: Beacon Company does residential real estate appraisals.There

Q92: A wholesale automobile company that buys and

Q93: Camden Company gathered the following information for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents