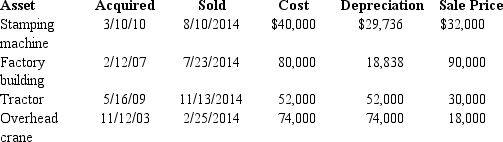

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as longterm capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: White Company acquires a new machine for

Q27: Part III of Form 4797 is used

Q28: Which of the following assets held by

Q40: 41. Copper Corporation sold machinery for $47,000 on

Q41: A business machine purchased April 10,2012,for $98,000

Q42: Section 1239 (relating to the sale of

Q43: An individual taxpayer has the gains

Q45: Business equipment is purchased on March 10,2013,used

Q46: Which of the following would extinguish the

Q47: A business taxpayer sold all the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents