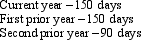

Yvonne is a citizen of France and does not have permanent resident status in the United States.During the last three years she has spent a number of days in the United States.  Is Yvonne treated as a U.S.resident for the current year?

Is Yvonne treated as a U.S.resident for the current year?

A) No,because Yvonne is a citizen of France.

B) No,because Yvonne was not present in the United States at least 183 days during the current year.

C) No,because although Yvonne was present in the United States at least 31 days during the current year,she was not present at least 183 days in a single year during the current or prior two years.

D) Yes,because Yvonne was present in the United States at least 31 days during the current year and 215 days during the current and prior two years (using the appropriate fractions for the prior years) .

Correct Answer:

Verified

Q82: Which of the following is a special

Q84: ForCo, a foreign corporation, receives interest income

Q85: Which of the following is not a

Q88: Waldo,Inc.,a U.S.corporation,owns 100% of Orion,Ltd.,a foreign corporation.Orion

Q89: Which of the following determinations requires knowing

Q100: Performance,Inc.,a U.S.corporation,owns 100% of Krumb,Ltd.,a foreign corporation.Krumb

Q103: Which of the following statements regarding a

Q108: Which of the following statements concerning the

Q115: Magdala is a citizen of Italy and

Q124: KeenCo, a domestic corporation, is the sole

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents