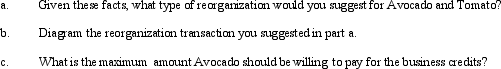

Present Value Tables needed for this question.Avocado Corporation wants to acquire Tomato Corporation because their businesses are complementary and Tomato has unused business credits of $63,000.Avocado is a manufacturer with a basis in its assets of $2.4 million (value of $3.1 million)and liabilities of $600,000.It is in the 35% tax bracket and uses a 10% discount factor when making investments.However,the Federal long-term tax-exempt rate is only 5%.Tomato is a distributor of a variety of products including those of Avocado's.Its basis in its assets is $2 million (value of $1.5 million)and has liabilities of $400,000.Avocado is willing to acquire only $1 million of Tomato's assets and all its liabilities for stock and $100,000 cash.Tomato will distribute its remaining assets,cash,and Avocado stock to its shareholders in exchange for their stock and then liquidate.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: What will cause the corporations involved in

Q72: For a "Type C" reorganization, substantially all

Q92: The acquiring corporation in a "Type G"

Q96: The yearly § 382 limitation is computed

Q97: Lyon has 100,000 shares outstanding that are

Q98: The tax treatment of the parties involved

Q99: The _ doctrine ensures that the acquiring

Q102: Gera owns 25,000 shares of Flow Corporation's

Q104: Discuss the influence of step transaction,sound business

Q106: Provide the formula for the § 382

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents