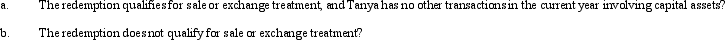

Tanya is in the 35% tax bracket.She acquired 1,000 shares of stock in Swan Corporation seven years ago for $250 a share.In the current year,Swan Corporation (E & P of $1.2 million)redeems all of her shares for $400,000.What are the tax consequences to Tanya if:

Correct Answer:

Verified

Q28: Indigo has a basis of $1 million

Q39: On April 7, 2011, Crow Corporation acquired

Q42: Which of the following statements is correct

Q45: After a plan of complete liquidation has

Q50: The stock of Penguin Corporation is held

Q60: During the current year, Goldfinch Corporation purchased

Q85: Ivory Corporation (E & P of $650,000)has

Q90: Hawk Corporation has 2,000 shares of stock

Q132: The gross estate of Raul, decedent who

Q133: Penguin Corporation purchased bonds (basis of $190,000)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents