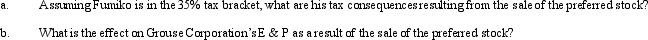

As of January 1 of the current year,Grouse Corporation has E & P of $600,000.Fumiko owns 320 shares of Grouse's common stock (basis of $45,000).On that date,Grouse Corporation declares and distributes a nontaxable preferred stock dividend,of which Fumiko receives 100 shares.Immediately after the stock dividend,the fair market value of one share of Grouse common stock is $500,and the fair market value of one share of Grouse preferred stock is $200.Two months later,Fumiko sells the 100 shares of preferred stock to an unrelated individual for $20,000.

Correct Answer:

Verified

Q23: Scarlet Corporation, the parent corporation, has a

Q39: On April 7, 2011, Crow Corporation acquired

Q44: The stock of Cardinal Corporation is held

Q56: In the current year, Dove Corporation (E

Q93: The stock in Camel Corporation is owned

Q97: Steve has a capital loss carryover in

Q99: Sam's gross estate includes stock in Tern

Q100: Egret Corporation has manufactured recreational vehicles for

Q132: The gross estate of Raul, decedent who

Q161: Explain the stock attribution rules that apply

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents