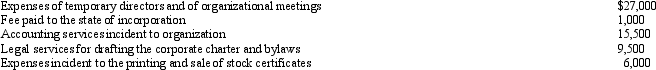

Emerald Corporation,a calendar year C corporation,was formed and began operations on April 1,2012.The following expenses were incurred during the first tax year (April 1 through December 31,2012) of operations:  Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2012?

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2012?

A) $0.

B) $4,550.

C) $5,000.

D) $7,400.

E) None of the above.

Correct Answer:

Verified

Q44: Bjorn owns a 60% interest in an

Q48: Jade Corporation, a C corporation, had $100,000

Q58: Elk, a C corporation, has $370,000 operating

Q59: Jason,an architect,is the sole shareholder of Purple

Q61: In the current year, Amber, Inc., a

Q67: During the current year,Owl Corporation (a C

Q68: During the current year,Kingbird Corporation (a calendar

Q71: Hippo, Inc., a calendar year C corporation,

Q77: Which of the following statements is incorrect

Q78: During the current year, Violet, Inc., a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents